Scaling Strategic Partner Integrations

My close working familiarity with the Archives.com digital partners created grounds for transition into the Ancestry umbrella during the 2012 $100 million acquisition of Archives.com by Ancestry.com. In the transition, I moved over 2,000 Archives.com affiliates into the new structure.

The focus of the first 6 months was to:

- Split apart affiliates whose ads were split between Archives and other Inflection brands.

- Change the link structure of all affiliate links due to migration onto Ancestry's servers.

- Transition all in-house display ads onto a new OpenX ad server.

- Migrate all digital partner records onto Ancestry's accounting systems.

- Manage internal and external expectations as to the attrition and scalability of affiliates in the new system.

While exciting, this transition caused considerable apprehension for many of our digital relationships. Two of Archives' previous value propositions against Ancestry.com were that 1. Archives was able to sustain more personal of relationships with our digital partners and 2. our affiliate payment terms were unmatched by Ancestry. During this time many of our affiliates surfaced their worries about becoming "lost" in the new system and feared losing previous growth momentum.

NEW AFFILIATE PAYMENT SYSTEMS

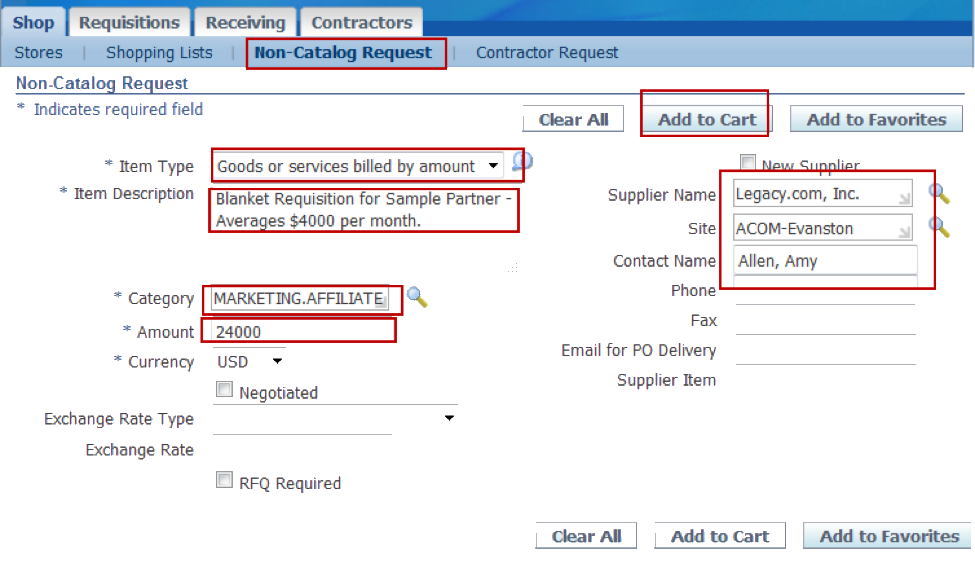

One of the biggest challenges that came with the transition was Ancestry's in-house payment remittance system. Archives automatically paid its partners on a bi-weekly basis, whereas Ancestry's systems were built to manually approve payments at most once per month once invoiced. In order to reduce affiliate attrition out of our program, I worked with the accounting team to rebuild Ancestry's Oracle payment system. Setting up a series of rules around expected payment amount, frequency, and minimum thresholds allowed Archives affiliates to maintain a more favorable payment differentiation status.

STRATEGIC API INTEGRATIONS

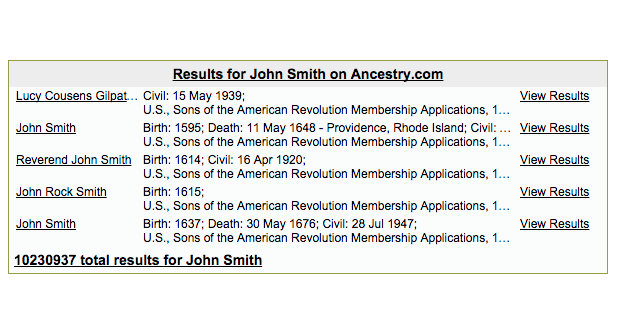

One of the largest growth drivers that led to our acquisition was Archives' use of API based ads on partner sites. We built these ads based on proprietary API's that referenced our database and returned a variety of names associated variables. I integrated these ads on affiliate sites where we could pass through names and location parameters. Due to the highly integrated nature of these placements, the resulting click-through and conversion rates strengthened our metrics beyond what our competition could afford to pay for the ad inventory.